What does the IRS say?

What does the IRS say?

Section 213 of the Internal Revenue Code (Code) medical expenses to be paid or reimbursed under a Health Savings Account (HSA), Health Flexible Spending Arrangement (FSA), Archer Medical Savings Account (Archer MSA), or Health Reimbursement Arrangement (HAS). The Code generally allows a deduction for expenses paid during the taxable year for medical care if certain requirements are met. Expenses for medical care under section 213 of the Code also are eligible to be paid or reimbursed under an HSA, FSA, Archer MSA, or HRA. However, if any amount is paid or reimbursed under an HSA, FSA, Archer MSA, or HRA, a taxpayer cannot also deduct the amount as a medical expense on the taxpayer's federal income tax return.

What qualifies as deductible medical expenses?

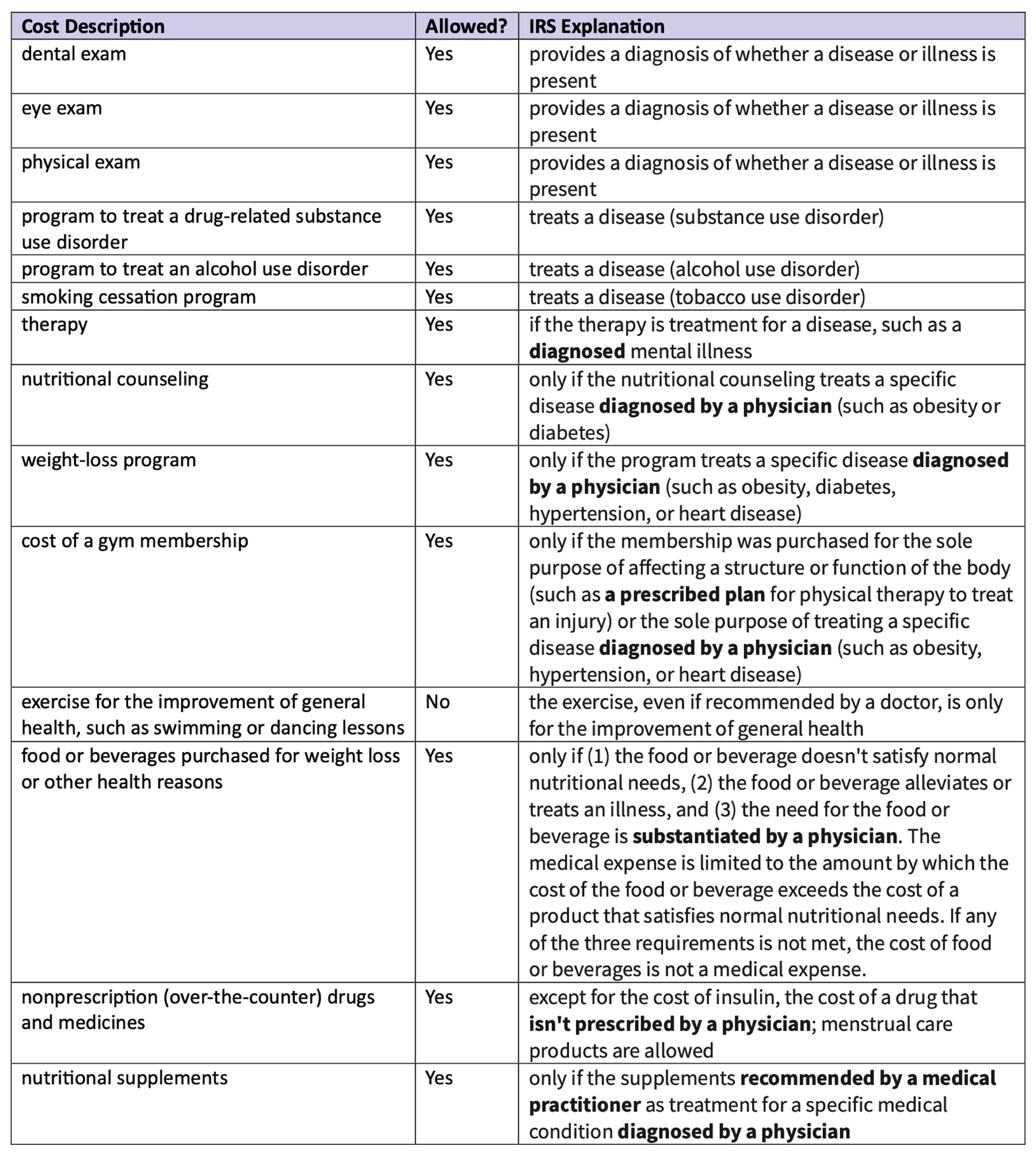

Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. They include the costs of equipment, supplies, and diagnostic devices needed for these purposes. They also include the costs of medicines and drugs that are prescribed by a physician. Medical expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health.

HSA, FSA, Archer MSA, or HRA Payable or Reimbursable Costs

Author:

Lloyd Boucher, EA, RICP®, FCEP

President & CEO, CA license # 0H26438

One-Fifth Financial, CA license # 0I18146

LloydBoucher.com